What Is the First Home Super Saver Scheme?

A practical guide to accessing your super and boosting your deposit with the FHSS scheme.

A practical guide to accessing your super and boosting your deposit with the FHSS scheme.

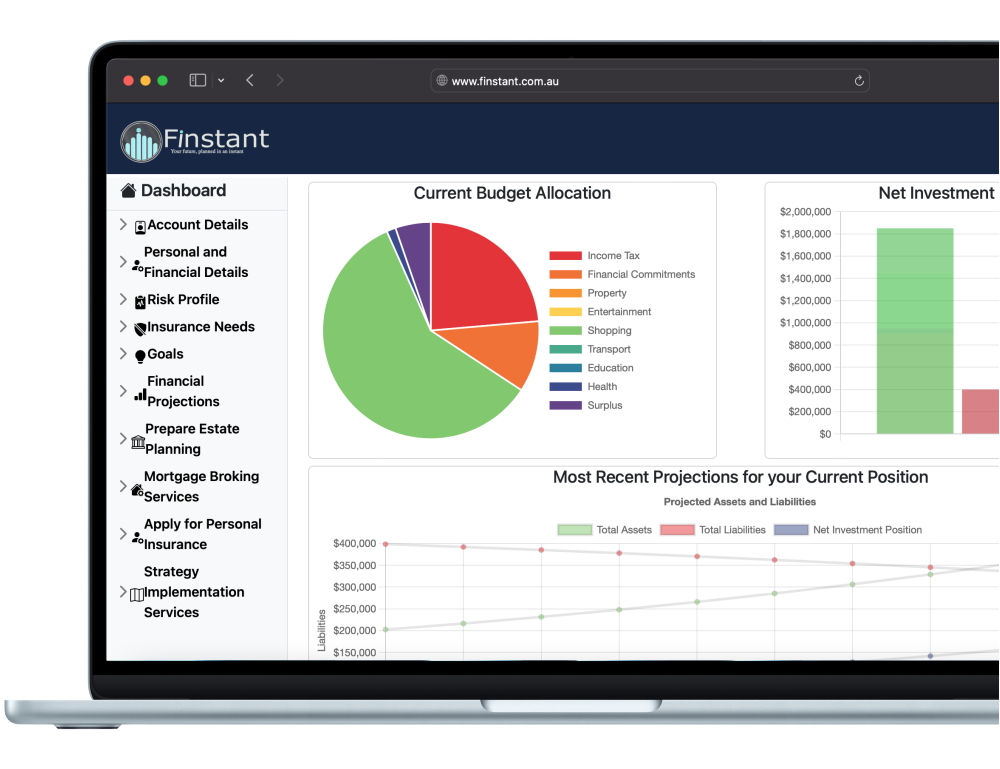

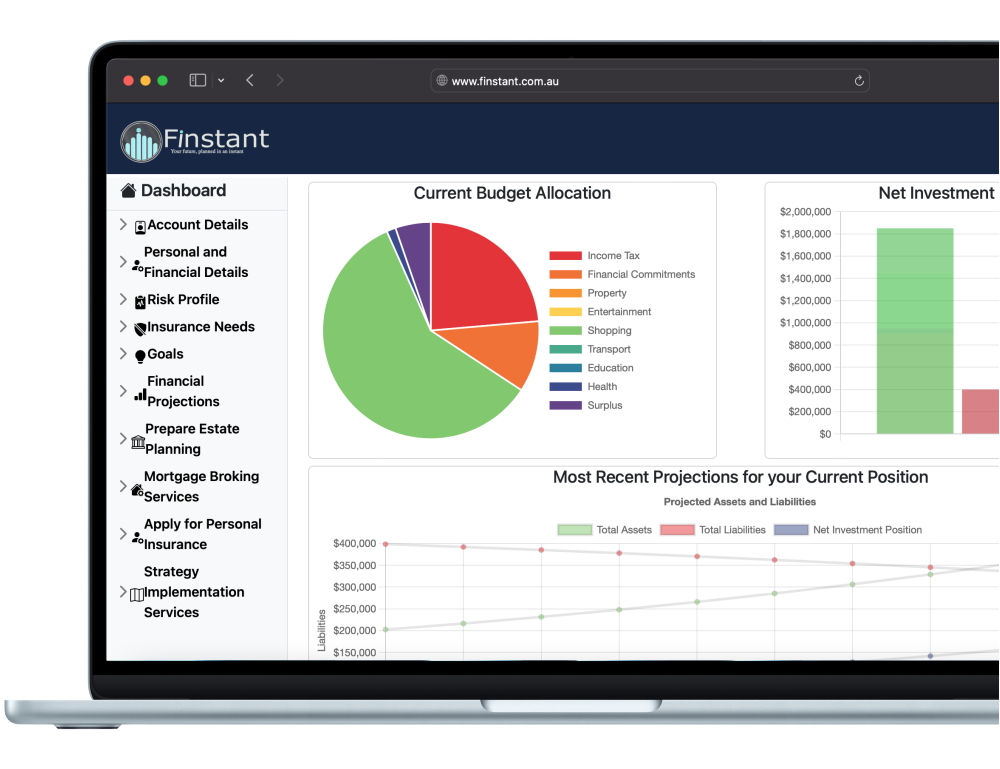

Calculate how much you could withdraw using the First Home Super Saver scheme based on your contributions.

See how FHSS can fast-track your savings goal compared to regular savings strategies.

Understand your eligibility, key dates, and how to request a release when you're ready to buy.

The First Home Super Saver Scheme was created in 2017 as part of the governments initiative to reduce pressure on housing affordability. Under the First Home Super Saver Scheme, first home savers who make voluntary contributions into the superannuation system can withdraw those contributions (up to certain limits) and an amount of associated earnings for the purposes of purchasing their first home.

The scheme benefits the users as concessional contributions to superannuation are only taxed at 15% which is usually less than your marginal income tax rate. When the funds associated with these concessional contributions are withdrawn to purchase a house they are taxed at marginal rates less a 30% tax offset. This sounds quite complicated and we'll see it in practice below.

Anyone who:

can apply for eligible contributions and the associated earnings to be released

At present, you are limited to contributing a maximum of

These contributions are also subject to the standard superannuation contribution caps of:

The type of contribution also impacts the releaseable amount:

Earnings on the funds contributed to the scheme are calculated using the Shortfall interest charge (SIC) rates published by the ATO each quarter. This rate is calculated as a 3% increase over the 90-day Bank Accepted Bill rate as published by the Reserve Bank. At present for the September 2025 quarter the rate is a daily rate of 0.018575340% or 6.78% annualised. The rate is calculated from the start of the month in which the contribution is made and calculated up until the date the ATO calculates it's determination for a release under the scheme.

Let’s build a realistic profile for our homebuyer, Joe Average — using real national averages to show how the First Home Super Saver Scheme works in practice.

Joe is a 22-year-old single male who has been working in sales (one of the most common occupations in Australia) for the past 12 months following graduating from university. He earns $112,819.20 per year plus super, which reflects the average full-time earnings for an Australian male. Joe has $13,069 in savings and a HECS-HELP debt of $27,640 — both figures based on national averages for Australians his age. So far, Joe has been working since he was 15 but has only received standard employer superannuation contributions and hasn’t made any voluntary contributions, meaning he has his full unused concessional contributions cap available. The average entry-level property price in Melbourne for first-home buyers is $670,000, however due to affordability the Joe is looking to spend $500,000 and would like to buy by 1 Jan 2029 with the projections beginning 1 Jul 2024.

To start modelling this scenario we need to create his profile which looks like:

| Profile Information | |

|---|---|

| Full Name | Mr Joe Average |

| Date of Birth | 20 Jun 2002 (Age: 22) |

| Gender | Male |

| Marital Status | Single |

| Address | 123 Median Ln, Melbourne VIC 3000 |

| Mobile | 0400 000 000 |

| Australian Tax Resident | Australian Resident for tax purposes |

Sales Representative for Sales Co

| Annualised Income | $ |

|---|---|

| Base Salary (plus super): | $112,819.20 |

| Total Remuneration excl. FBT, incl. Super | $125793.41 |

| Bank Account | Current Balance | Offset Account | Current Interest Rate | Annual Interest | Joe's Ownership: |

|---|---|---|---|---|---|

| BigBank - Savings Account | $13,069.00 | No | 4.35% | $568.50 | 100.00% |

| HECS-HELP | Balance | Additional repayments |

|---|---|---|

| HECS-HELP Loan | $27,640.00 | $0 |

| Fund | Member Number | Balance |

|---|---|---|

| Generic Super | 10101012020 | $45,000.00 |

| Tax Breakdown | Tax-free component | Taxable-taxed component | Taxable-untaxed component |

|---|---|---|---|

| $0.00 | $45,000.00 | $0.00 |

| Financial Year Ending | Unused Concessional Cap |

|---|---|

| 30 June 2020 | $22,459.00 |

| 30 June 2021 | $23,594.00 |

| 30 June 2022 | $24,789.00 |

| 30 June 2023 | $24,942.00 |

| 30 June 2024 | $18,349.00 |

| Income Source | Forecast Annualised Income |

|---|---|

| Employment Income | |

| Sales Representative at Sales Co: | $112,819.20 |

| Interest Earned | |

| BigBank Savings Account: | $568.50 |

| Total Income | $113,387.70 |

| Income Tax | |

| Income Tax Payable (Incl. Medicare) | $26,995.26 |

| Total Income Tax | $26,995.00 |

| Net Income | $86,392.44 |

| Expenses | Forecast Annualised Expenses |

|---|---|

| Financial Commitments | |

| Rental Payments | |

| Rental payments - 123 Median Ln: | $20,800.00 |

| HECS-HELP Loans | |

| HECS-HELP estimated repayments: | $7,920.34 |

| HECS-HELP additional repayments: | $0.00 |

| Total Financial Commitments | $20,800.00 |

| Property Expenses | |

| Electricity: | $600.00 |

| Gas: | $480.00 |

| Water Rates: | $360.00 |

| Other Property Expenses | |

| Total Property Expenses | $1,440.00 |

| Lifestyle & Entertainment Expenses | |

| Phone & Internet | |

| Mobile Phone Joe's Phone and Internet: | $900.00 |

| Pay TV, Streaming & Subscriptions (incl. Newspaper & Magazines) | |

| Streaming: | $360.00 |

| Gym & Sporting Memberships | |

| Gym Membership: | $1,040.00 |

| Hobbies | |

| Hobbies: | $600.00 |

| Bars, Clubs, Pubs & Alcohol at Home | |

| Pub: | $2,600.00 |

| Alcohol at Home: | $1,200.00 |

| Restaurants, Takeaway, Bought Lunch & Coffee | |

| Eating out: | $3,120.00 |

| Holidays and Travel | |

| Annual Holidays: | $5,000.00 |

| Donations | |

| Charitable Donations: | $240.00 |

| Total Lifestyle & Entertainment Expenses | $15,060.00 |

| Shopping Expenses | |

| Groceries / Supermarket | |

| Groceries: | $10,400.00 |

| Clothing & Shoes | |

| Clothes: | $3,600.00 |

| Cosmetics | |

| Hairdressing | |

| Barber: | $480.00 |

| Total Shopping Expenses | $14,480.00 |

| Transport Expenses | |

| Vehicle Running Costs | |

| Fuel: | $1,440.00 |

| Registration: | $1,320.00 |

| Servicing Cost: | $1,000.00 |

| Maintenance: | $400.00 |

| Total Transport Expenses | $4,160.00 |

| Health Expenses | |

| Health Insurance | |

| Hospital only InsureCo: | $1,040.00 |

| Doctors, Dental, Physio etc. | |

| Dentist: | $200.00 | Total Health Expenses | $1,240.00 |

| Total Expenses: | $57,180.00 |

| Budgeted Surplus: | |

| Annual Surplus: | $29,212.44 |

| Monthly Surplus: | $2,434.37 |

| Weekly Surplus: | $561.78 |

Based on his budget surplus, Joe will comfortably be able to make the maximum allowable annual contributions under the scheme. Starting from 1 July 2024, we can schedule quarterly concessional contributions of $3,750 to his superannuation fund. These contributions will continue consistently for three and a half years, with the final contribution reduced to $1,250 to ensure the total remains within the scheme’s contribution cap.

| Eligible for FHSS Scheme | |

|---|---|

| Eligibile | Yes |

| Date of Contribution (Made/Planned) | Contribution Type | Fund | Amount |

|---|---|---|---|

| 30 Sep 2024 | Concessional | Generic Super - 10101012020 | $3,750.00 |

| 31 Dec 2024 | Concessional | Generic Super - 10101012020 | $3,750.00 |

| 30 Mar 2025 | Concessional | Generic Super - 10101012020 | $3,750.00 |

| 30 Jun 2025 | Concessional | Generic Super - 10101012020 | $3,750.00 |

| 30 Sep 2025 | Concessional | Generic Super - 10101012020 | $3,750.00 |

| 31 Dec 2025 | Concessional | Generic Super - 10101012020 | $3,750.00 |

| 30 Mar 2026 | Concessional | Generic Super - 10101012020 | $3,750.00 |

| 30 Jun 2026 | Concessional | Generic Super - 10101012020 | $3,750.00 |

| 30 Sep 2026 | Concessional | Generic Super - 10101012020 | $3,750.00 |

| 30 Dec 2026 | Concessional | Generic Super - 10101012020 | $3,750.00 |

| 30 Mar 2027 | Concessional | Generic Super - 10101012020 | $3,750.00 |

| 30 Jun 2027 | Concessional | Generic Super - 10101012020 | $3,750.00 |

| 30 Sep 2027 | Concessional | Generic Super - 10101012020 | $3,750.00 |

| 30 Dec 2027 | Concessional | Generic Super - 10101012020 | $1,250.00 |

| Total | $50,000.00 |

With Joe's current financial position established, we can now move on to setting up his property purchase goal. Joe plans to buy an average entry-level home in Victoria valued at $500,000. To simplify the process, property purchase costs are automatically calculated when the goal is created, though they can be adjusted if needed. The First Home Super Saver (FHSS) release amount will be calculated based on the expected purchase date, Joe’s contribution history, and any applicable shortfall interest on future contributions. When creating a new property goal you can also estimate borrowing capacity to help ensure the planned mortgage is achievable. We also model future property-related expenses, which will eventually replace Joe’s current rental costs once he becomes a homeowner.

| New Property | Net Cost | Priority | TimeFrame |

|---|---|---|---|

| Purchase First Home on 1 Jan 2029 | $ 450,520.37 | Highest | 3.00 years |

| Property Type | Ownership Structure | Ownership Share |

|---|---|---|

| Principal place of residence | Individually owned | 100.00% |

| Property Purchase Costs | Amount |

|---|---|

| Purchase Price Ex. Costs | $500,000.00 |

| Stamp Duty | $0.00 |

| Title Transfer Fee | $1,266.00 |

| Mortgage Registration Fee | $118.90 |

| Conveyancing Fees | $1,000.00 |

| Lenders Mortgage Insurance | $0.00 |

| Other Costs | $0.00 |

| Purchase Price Incl Costs | $502,384.90 |

| First Home Super Saver Release | Amount |

|---|---|

| Estimated Release (Before Tax) | $51,351.96 |

| Estimated Tax at Current Marginal Tax Rate | $23108.38 |

| Estimated Tax Offset | $15,405.59 |

| Estimated Release (After Tax) | $43,649.17 |

| Mortgage Details | |

|---|---|

| Mortgage | Big Bank Basic mortgage |

| Loan Amount | $400,000.00 |

| Loan Term | 360 months |

| Expected Interest Rate | 6.00% |

| Estimated Repayments | $2,398.20 Monthly |

| Goal Funding: |

|---|

|

| First Home Budgeted Expenses | Annualised Expenses |

|---|---|

| Council Rates: | $1,400.00 |

| Body Corporate Fees: | $0 |

| Maintenance: | $400.00 |

| Electricity: | $2,400.00 |

| Gas: | $1,200.00 |

| Water Rates: | $1,200.00 |

| House and Contents Insurance: | $2,000.00 |

| Emergency Services Levy: | $200.00 |

| Other Expenses | $0 |

| Total Property Expenses | $6,800.00 |

With Joe’s scenario fully defined, we can now run the model and explore the outcomes.

Over a three-and-a-half-year period, Joe contributes the maximum $50,000 to his superannuation using concessional contributions. Under the FHSS scheme’s rules, which apply a government-determined earnings rate (based on the ATO’s Shortfall Interest Charge), these contributions grow to a projected releasable amount of $51,505.35 by 1 January 2029, Joe’s target date to purchase his first home.

However, because of Joe’s income at the time of release, a significant portion of the withdrawal is taxed at a higher marginal rate of 37%, rather than the 30% he would have originally paid when making the contributions. After applying the 30% tax offset that the scheme provides, the net benefit is reduced with the estimated release amount of $51,505.35 reduced to $43,370.75 after tax.

To assess the true value of the FHSS strategy, our modelling automatically creates a comparison scenario where the scheme is not used. In this alternative, Joe’s surplus income is instead directed into a standard savings account earning 4.35% interest, with no FHSS contributions made. This side-by-side comparison reveals the real impact of the scheme under Joe’s circumstances. In the first year, Joe is able to save a total of $23,927.40 after tax when using the FHSS strategy, compared to $21,377.40 in the scenario where no FHSS contributions are made. However, once we project forward to the 2029 financial year—when the property is purchased and all tax effects are fully realised, Joe’s overall Net Investment Position (i.e. net wealth) is actually $13,285 lower than if he had not used the scheme.

The First Home Super Saver Scheme can be an effective strategy, but as this example shows, the benefit is highly dependent on individual factors such as income, tax brackets, and timing. Personalised modelling is essential to determine whether it’s the right fit for your situation.

In this scenario it is forecast that you will have a cashflow surplus of $11,177.40 for the year to 30 June 2025. This surplus will then grow to:

| Projected Cashflow | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Financial Year Ended | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Total Income | $113,387.70 | $116,694.40 | $120,097.36 | $123,611.02 | $638,208.69 | $128,722.48 | $132,799.11 | $137,023.19 | $141,388.36 | $145,882.40 |

| Total Expenses | $102,210.30 | $104,924.95 | $107,444.72 | $99,684.05 | $627,010.44 | $108,365.71 | $110,886.97 | $113,746.95 | $117,076.70 | $120,499.12 |

| Net Cashflow | $11,177.40 | $11,769.45 | $12,652.64 | $23,926.97 | $11,198.25 | $20,356.77 | $21,912.14 | $23,276.24 | $24,311.66 | $25,383.28 |

| Income Tax Calculation | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Full Financial Year Ended | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Assessable Income | ||||||||||

| Employment Income | ||||||||||

| Sales Representative at Sales Co | $112,819.20 | $115,639.68 | $118,530.67 | $121,493.94 | $124,531.29 | $127,644.57 | $130,835.68 | $134,106.58 | $137,459.24 | $140,895.72 |

| Investment Income | ||||||||||

| BigBank Savings Account | $568.50 | $1,054.72 | $1,566.69 | $2,117.08 | $3,157.90 | $1,077.91 | $1,963.43 | $2,916.61 | $3,929.12 | $4,986.68 |

| First Home Super Saver Release | ||||||||||

| Generic Super (Accumulation) | $0.00 | $0.00 | $0.00 | $0.00 | $51,505.35 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Total Assessable Income | $113,387.70 | $116,694.40 | $120,097.36 | $123,611.02 | $179,194.54 | $128,722.48 | $132,799.11 | $137,023.18 | $141,388.36 | $145,882.40 |

| Tax Deductions | ||||||||||

| Charitable Donations | $240.00 | $246.00 | $252.15 | $258.45 | $264.92 | $271.54 | $278.33 | $285.28 | $292.42 | $299.73 |

| Personal Concessional Super Contributions | $15,000.00 | $15,000.00 | $15,000.00 | $5,000.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Total Tax Deductions | $15,240.00 | $15,246.00 | $15,252.15 | $5,258.45 | $264.92 | $271.54 | $278.33 | $285.28 | $292.42 | $299.73 |

| Taxable Income | ||||||||||

| Taxable Income | $98,147.70 | $101,448.40 | $104,845.21 | $118,352.56 | $178,929.63 | $128,450.94 | $132,520.79 | $136,737.90 | $141,095.95 | $145,582.67 |

| Tax Payable | ||||||||||

| Income Tax Payable | $20,232.31 | $21,222.52 | $21,973.56 | $26,759.29 | $52,127.63 | $29,889.79 | $31,151.44 | $32,719.43 | $34,724.14 | $36,788.03 |

| Medicare Levy | $1,962.95 | $2,028.97 | $2,096.90 | $2,367.05 | $3,578.59 | $2,569.02 | $2,650.42 | $2,734.76 | $2,821.92 | $2,911.65 |

| First Home Super Saver Release Offset | $0.00 | $0.00 | $0.00 | $0.00 | $15,451.61 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Total Tax Payable | $22,195.26 | $23,251.49 | $24,070.47 | $29,126.35 | $40,254.61 | $32,458.81 | $33,801.86 | $35,454.19 | $37,546.05 | $39,699.68 |

| Cumulative Total Tax Payable | $22,195.26 | $45,446.75 | $69,517.22 | $98,643.57 | $138,898.18 | $171,356.99 | $205,158.85 | $240,613.04 | $278,159.10 | $317,858.78 |

In this scenario at the end of the first financial year you are projected to have total assets of $121,295.18. This is the projected to:

| Projected Assets | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Financial Year Ended | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Property | ||||||||||

| First Home | $0.00 | $0.00 | $0.00 | $0.00 | $517,925.82 | $555,475.45 | $595,747.42 | $638,939.10 | $685,262.19 | $734,943.70 |

| Investment Assets | ||||||||||

| BigBank Savings Account | $24,246.40 | $36,015.86 | $48,668.47 | $72,595.42 | $24,779.52 | $45,136.30 | $67,048.44 | $90,324.66 | $114,636.34 | $140,019.62 |

| Superannuation | ||||||||||

| Generic Super (Accumulation) | $71,548.78 | $100,604.01 | $131,860.87 | $157,022.31 | $125,054.85 | $146,168.33 | $168,992.21 | $193,646.93 | $220,261.04 | $248,971.74 |

| Non-Financial Assets | ||||||||||

| Ford Ranger | $25,500.00 | $21,675.00 | $18,423.75 | $15,660.19 | $13,311.16 | $11,314.49 | $9,617.31 | $8,174.72 | $6,948.51 | $5,906.23 |

| Total Assets | $121,295.18 | $158,294.87 | $198,953.09 | $245,277.92 | $681,071.35 | $758,094.57 | $841,405.38 | $931,085.41 | $1,027,108.08 | $1,129,841.29 |

In this scenario at the end of the first financial year you are projected to have a total superannuation balance of $71,548.78. This is the projected to:

| Superannuation | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Financial Year Ended | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Concessional Contribution Cap | $30,000.00 | $30,000.00 | $30,000.00 | $30,000.00 | $32,500.00 | $32,500.00 | $32,500.00 | $35,000.00 | $35,000.00 | $35,000.00 |

| Concessional Cap incl. Carry Forward Balance | $144,133.00 | $123,699.79 | $101,229.03 | $77,216.35 | $65,195.08 | $64,402.32 | $79,559.18 | $97,735.66 | $115,866.55 | $123,950.72 |

| Employer Contributions | $12,974.21 | $13,876.76 | $14,223.68 | $14,579.27 | $14,943.75 | $15,317.35 | $15,700.28 | $16,092.79 | $16,495.11 | $16,907.49 |

| Personal Concessional Contributions incl. Salary Sacrifice | $15,000.00 | $15,000.00 | $15,000.00 | $5,000.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Unused Concessional Cap | $2,025.79 | $1,123.24 | $776.32 | $10,420.73 | $17,556.25 | $17,182.65 | $16,799.72 | $18,907.21 | $18,504.89 | $18,092.51 |

| Non-concessional Contribution Cap | $120,000.00 | $120,000.00 | $120,000.00 | $120,000.00 | $130,000.00 | $130,000.00 | $130,000.00 | $140,000.00 | $140,000.00 | $140,000.00 |

| Bring Forward Balance Available | $360,000.00 | $360,000.00 | $360,000.00 | $360,000.00 | $360,000.00 | $390,000.00 | $390,000.00 | $390,000.00 | $420,000.00 | $420,000.00 |

| Personal Non-concessional Contributions | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Unused Non-concessional Cap | $120,000.00 | $120,000.00 | $120,000.00 | $120,000.00 | $130,000.00 | $130,000.00 | $130,000.00 | $140,000.00 | $140,000.00 | $140,000.00 |

| Total Superannuation Balance | $71,548.78 | $100,604.01 | $131,860.87 | $157,022.31 | $125,054.85 | $146,168.33 | $168,992.21 | $193,646.93 | $220,261.04 | $248,971.74 |

In this scenario your first home super saver scheme release has been calculated as follows:

| FHSS | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Financial Year Ended | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Generic Super (Accumulation) | ||||||||||

| Eligible Contributions | $15,000.00 | $15,000.00 | $15,000.00 | $5,000.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Releasable Amount | $13,184.59 | $27,261.01 | $42,324.19 | $49,770.20 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

Your FHSS release is anticipated to occur on 1 Jan 2029 with a total release of $51,505.35. It is projected that this relase will be subject to $23,586.21 of income tax less the $15,451.61 tax offset.

To assess the benefit of the First Home Super Saver scheme, the strategy has been modelled without those contributions. Comparing the two scenarios, the total tax paid, including the tax paid through superannuation, from the beginning of the projection until 30 June 2029 is reduced by $1,640.22. Your net assets are $13,285.25 lower than they would be without using the scheme when it comes time to purchase your house.

Based on your current repayment schedule and any allocation of surplus cashflow towards your debt it is projected that you will be able to repay your debts as follows:

Mortgage - First Home: Big Bank Basic mortgage

HECS HELP Loan - Joe

| Property Type | Ownership Structure | Ownership Share |

|---|---|---|

| Principal place of residence

|

Individually owned | 100.00% |

| Property Purchase Costs | Amount |

|---|---|

| Purchase Price Ex. Costs | $500,000.00 |

| Stamp Duty | $0.00 |

| Title Transfer Fee | $1,266.00 |

| Mortgage Registration Fee | $118.90 |

| Conveyancing Fees | $1,000.00 |

| Lenders Mortgage Insurance | $0.00 |

| Other Costs | $0.00 |

| Purchase Price Incl Costs | $502,384.90 |

| First Home Super Saver Release | Amount |

|---|---|

| Projected Release (Before Tax) - Generic Super (Accumulation): | $51,505.35 |

| Projected Tax Payable on Release: | $23,586.21 |

| Projected Tax Offset on Release: | $15,451.61 |

| Projected Net Release: | $43,370.75 |

| Mortgage Details | |

|---|---|

| No Mortgage |

| First Home Budgeted Expenses | Annualised Expenses |

|---|---|

| Council Rates: | $1,400.00 |

| Body Corporate Fees: | $0 |

| Maintenance: | $400.00 |

| Electricity: | $2,400.00 |

| Gas: | $1,200.00 |

| Water Rates: | $1,200.00 |

| House and Contents Insurance: | $2,000.00 |

| Emergency Services Levy: | $200.00 |

| Other Expenses | $0 |

| Total Property Expenses | $6,800.00 |